Greetings. In a month’s time COP26 will be well underway in Glasgow. Unsurprisingly the climate, sustainability and ESG coverage in the press is growing, and there’s a constant seesaw of emotions as we see messages about who may or may attend and what they might or might not agree to.

Join in our poll to share how much you expect to contribute to the outcome of this critical event.

Last week we promised some informative webinars. We’re still finalising times. Find out more via our Insurance ESG online community.

In the meantime plenty of food for thought below.

Paolo & Brandon

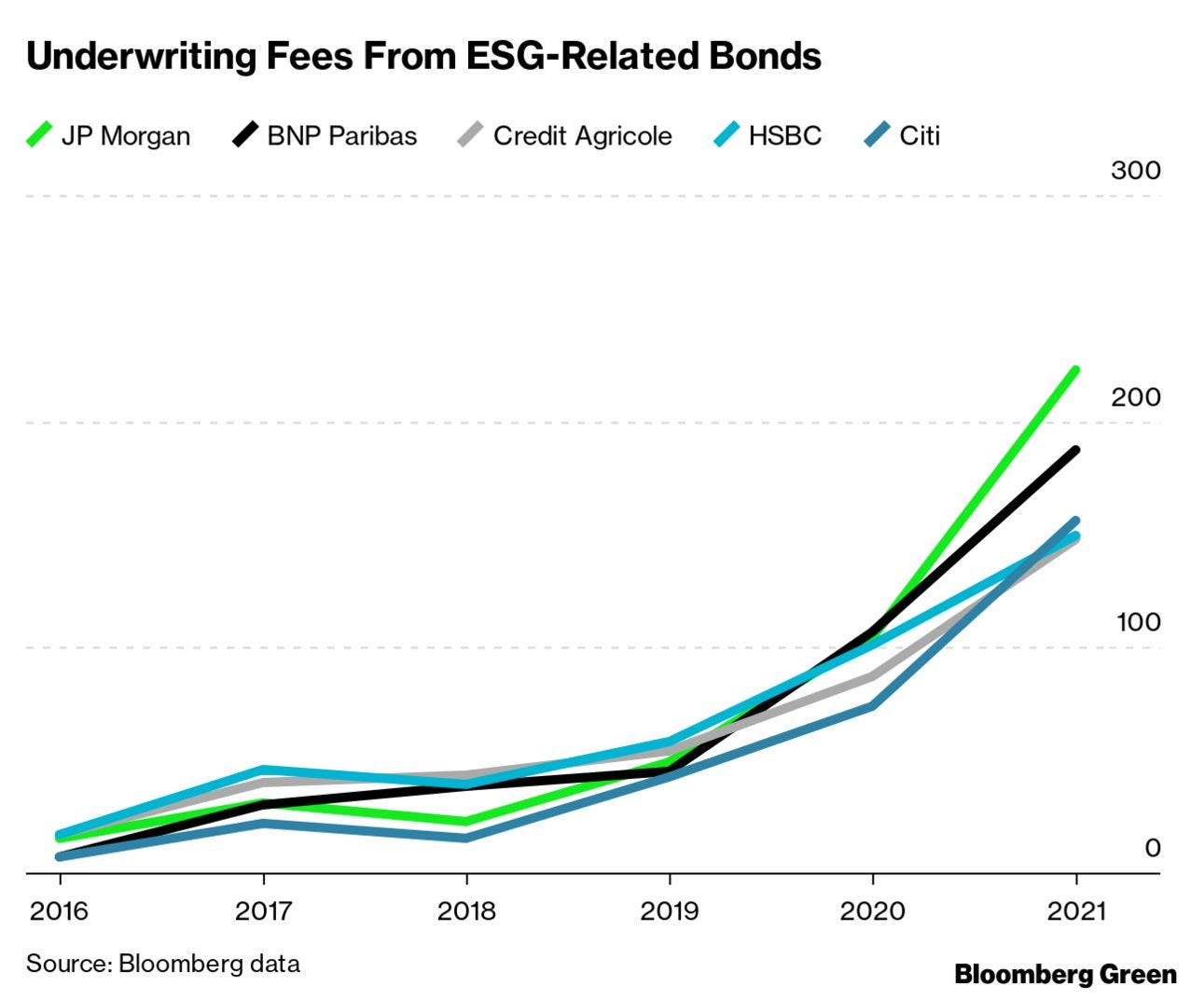

Chart of the week: Fees from ESG-related bonds

Via Tom Quinson’s Bloomburg ‘Good Business’ newsletter

Bankers have form when it comes to following the money, and an ever-growing opportunity appears to be growing in ESG-related financial instruments. In some cases the value appears to be outstripping what they earn on fossil-fuel-related business. Is the same opportunity open to insurers?

Banks have earned about $3.6 billion in fees in 2021 from arranging sales of bonds advertised as instruments of green, social or sustainable development for companies, governments and other organizations, according to data compiled by Bloomberg. That’s more than double the $1.6 billion banks pocketed so far this year from issuing debt for fossil-fuel companies.

About $750 billion of ESG-related bonds have been issued this year, compared with $468 billion during all of 2020, Bloomberg data show.

“Investment banks are almost always driven by what customers want, and demand for environmentally-friendly bonds isn’t going to wane anytime soon,” said Jeff Harte, an analyst at Piper Sandler Cos.

Harte adds there are growing regulatory and political pressures on the financial industry to do something about the deteriorating state of the planet, and that’s also providing an incentive to participate in ESG.

Insurancers Take the Lead on ESG/Sustainability Initiatives

Scott Seaman, JDSupra, 1 October 2021

In the contemporary corporate world, as insurers and other companies tackle ESG, they are discovering that ESG is not only "good business," but increasingly, that ESG components are becoming mandatory or "essential business."

It is fair to say that ESG is near the top of the list of issues receiving attention from many executives and boards of directors of insurance companies and corporate policyholders.

Directors and officers insurance market – broker and client concerns

Mia Wallace, Insurance Business UK, 30 September 2021

Given the increasing need for accountability when it comes to ESG, Ball highlighted that the actions taken by senior leaders need to be evaluated on an ongoing basis. If a company has addressed ESG or climate change targets then they need to ensure that they continue hitting those targets every year and, if they aren’t, to evaluate why that is the case.

UN development arm launches disaster insurance programme

Reuters, 28 September 2021

Disaster recovery costs the world’s 77 poorest countries an average of $29 billion annually, the UNDP said in a statement.

Only 3% of this cost is covered by insurance, forcing countries to bear the cost of recovery themselves or rely on humanitarian aid, the UNDP added.

The UNDP is aiming to help create insurance protection from socio-economic, climate and health-related disasters in more than 50 developing countries by 2025, it said.

"Insurance and risk-finance products, tools and services can secure our critical infrastructure, protect our agriculture and businesses, and preserve critical ecosystems that make life on earth possible," said UNDP Administrator Achim Steiner.

Guy Carp’s Trace: ESG, climate change move to top of carrier agenda in 2021

Eileen AJ Connelly, Insurance Insider, 28 September 2021

Environmental, social, and governance (ESG) issues have become a significant concern for insurance carrier executives as they seek guidance in identifying the risks ahead and the policies they need to adopt, according to John Trace, CEO of North America at Guy Carpenter.

“In the last six months, ESG has been a C-suite conversation with more of our clients than almost any other topic,” Trace said while speaking as part of the Inside P&C North America Conference. “We are having many, many carriers reach out, asking for guidance around ESG and kind of benchmarking what other companies are doing.”

Read more (may require subscription)…

Climate change will challenge thriving construction industry – Marsh report

Ryan Smith, Insurance Business, 28 September 2021

“The construction and engineering industry is entering a period of exciting opportunity, but also one that will require new ways of approaching risk by the insurance and reinsurance sectors,” said Simon Liley, co-head of global engineering at Guy Carpenter.

“These dynamics call for effective knowledge-sharing from industry innovators at one end all the way through to reinsurance actuaries at the other. Understanding the shifting profile of exposure, technology, and sources of capital will be important to enable insurers and reinsurers to establish underwriting platforms and offer products that meet the construction industry’s changing needs.”

Five trends driving ESG risks

Shanil Williams, Property Casualty 360, 28 September 2021

Environmental, social and governance (ESG) metrics can be hard to measure, but the risks surrounding them are increasing as governments and citizens exert pressure on businesses to change their ways for the greater good.

Despite the shock it inflicted across the globe, the COVID-19 crisis does not appear to have halted the march of ESG activists and agendas into the boardroom. If anything, it seems to have accelerated it, as a concern for the collective well-being has been thrown into sharper relief.

A changing boardroom climate: insurance planning with ESG in mind

Michael Zigelman, Patrick Kennell & Matthew Lee, Reuters, 24 September 2021

Corporate risk managers and D&O insurers might expect increased claim activity for ESG-related challenges. Like the harbingers of event-driven litigation which we saw with the opioid crisis and data privacy breaches, as examples, lawsuits stemming from significant environmental or natural disasters, superstorms, and social events like the #MeToo movement are all-but-certain to increase.

But while these "bad news" events not directly related to financial results might be difficult to forecast, lawsuits emanating from perceived poor governance standards, product problems, exploitation in the supply chain, etc. might be mitigated by corporate decision-makers evaluating their ESG risks and adopting policies to combat them. With the focus on ESG-related issues increasing, certainly it should be expected that companies and their leaders will undertake a thorough review of all types of risk which could impact their insurance coverage and review relevant provisions in their D&O policies.

Demystifying COP26

Lucia Simmons & Rebekah Clarke, The Carbon Literacy Project, September 2021

A simple overview of COP26’s background and aspirations. As a reminder, the main goals are:

Secure global net zero by mid-century and keep within the 1.5° reach.

Adapt to protect communities and natural habitats.

Mobilise finance.

Work together to deliver.

Swiss Re's Weymann: Data access is essential to sustainable underwriting

Rodrigo Amaral, Insurance Day, 23 September 2021

The reinsurance giant's head of sustainability on how the company has developed an online tool to enable its underwriters to tackle difficult ESG issues

Read more (may require a subscription)…

ESG data vendor of the year: FactSet

Risk.net, 28 September 2021

It’s no surprise that one of the biggest challenges when it comes to environmental, social and governance (ESG) investing is that there are huge gaps in the data. Where companies report it, it is often delayed, incomplete and biased.

Many ESG data providers rely on company-reported data and make subjective, analyst-driven rating decisions using proprietary methodologies. There is a lack of transparency on what ESG ratings assess because data providers rely on already-lacking data.

Read more (may require a subscription)…

Rakhi Kumar Joins Climate Platform Persefoni's Sustainability Advisory Board

PR Newswire, 30 September 2021

Persefoni, the climate platform for enterprises and institutional investors to provide real-time assessments and management of their carbon footprint, today announced that Rakhi Kumar will serve on the company's Sustainability Advisory Board (SAB). Kumar is the Senior Vice President of Sustainability Solutions at Liberty Mutual Insurance.

Japanese Life Insurance Companies Collaborate to Support Climate Action Through World Bank Bonds

Insurance News Net, 30 September 2021

A group of Japanese life insurance companies invested in the bonds to support the financing of climate projects and the critical role the multilateral development banks play in providing climate finance in developing countries as momentum builds for the United Nations Climate Change Conference, known as COP 26, in November 2021.

Carbon Literacy Action Day

If your Talent teams are looking for ESG related training, then do share with them details of this initiative from The Carbon Literacy Project. The aim is to use the start of OP26 on 1 November as a chance to make people more carbon literate.